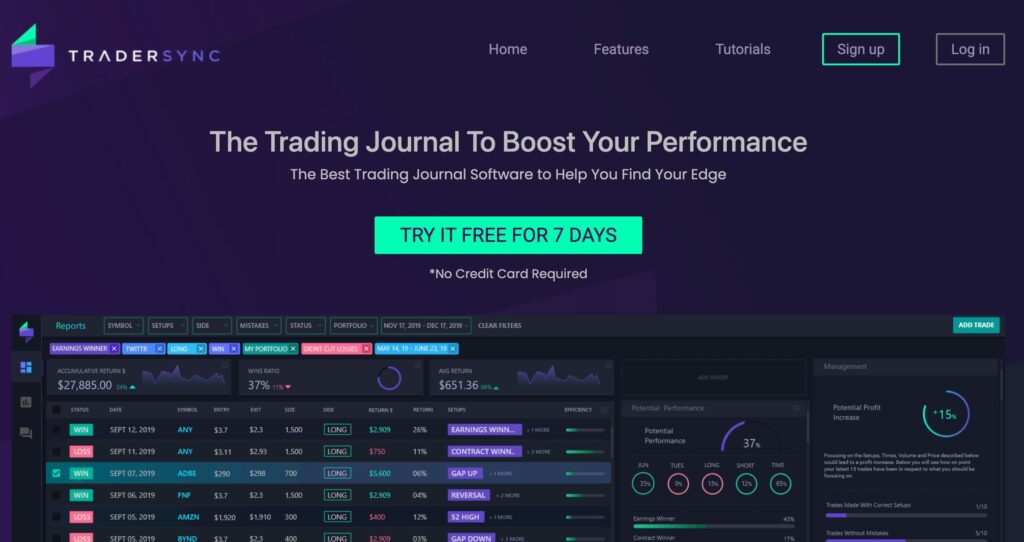

If you’re looking for a trading journal to help you improve your trading skills, you might want to consider TraderSync.

TraderSync offers many different products to identify mistakes and improve your trading strategies. In this TraderSync review, we’ll take a closer look at all the features this trading journal has to offer.

What is TraderSync?

TraderSync is an online trading journal that is designed to help traders learn from their past trades and improve their trading strategies. It is a powerful tool that allows you to analyze every aspect of your trading history, from entry and exit points to the emotions you felt during each trade.

With TraderSync, you can track your trades, review your performance, and identify areas where you can improve. The platform offers a range of features, including customizable categories for setups and mistakes, detailed trade analysis, and advanced reporting tools.

TraderSync is easy to use, with a user-friendly interface that makes it simple to navigate and access all of its features. It is also highly interactive, allowing you to collaborate with other traders and share your insights and experiences.

One of the key benefits of TraderSync is that it helps you to work on your emotions by constantly mining your data to look for points of weakness where mistakes are causing you to lose money. This can be a game-changer for traders who struggle with emotional decision-making and want to improve their discipline and focus.

Overall, TraderSync is a highly effective trading journal that can help you to learn from your past trades and grow as a trader. Whether you are a beginner or an experienced trader, it is a valuable tool that can help you to achieve your trading goals.

Key Features of TraderSync

TraderSync is a trading journal that offers a variety of tools to help traders track and analyze their trades. Here are some of the key features of TraderSync:

Real-Time Tracking

TraderSync allows you to track your trades in real-time, so you can see how your positions are performing at any given moment. You can also set up alerts to notify you when certain events occur, such as when a trade reaches a certain price level or when a stop loss is triggered.

Advanced Analytics

TraderSync offers advanced analytics tools that allow you to analyze your trades in detail. You can view your trades by instrument, time frame, or strategy, and you can also filter your trades by various criteria, such as entry and exit points, profit and loss, and more.

Performance Reports

TraderSync provides detailed performance reports that allow you to track your progress over time. You can view your performance by day, week, month, or year, and you can also see your performance broken down by instrument, time frame, or strategy.

In conclusion, TraderSync offers a variety of tools to help traders track and analyze their trades. With real-time tracking, advanced analytics, and detailed performance reports, TraderSync can help you improve your trading skills and become a more successful trader.

User Experience

TraderSync offers an intuitive, user-friendly interface that makes it easy to track your trades and analyze your performance. The platform is designed to help you identify mistakes and improve your trading habits, whether you are a beginner or an experienced trader.

One of the standout features of TraderSync is its ability to import trades from your brokerage account, which saves you time and ensures that your data is accurate. The platform also offers a variety of tools for analyzing your trades, including charts, graphs, and statistics.

In addition, TraderSync allows you to set up custom alerts and notifications, so you can stay on top of your trades and make informed decisions. The platform also offers a mobile app, which makes it easy to track your trades and analyze your performance on the go.

Overall, the user experience with TraderSync is excellent. The platform is easy to use and offers a wide range of features and tools to help you improve your trading performance. Whether you are a beginner or an experienced trader, TraderSync is a great choice for tracking your trades and analyzing your performance.

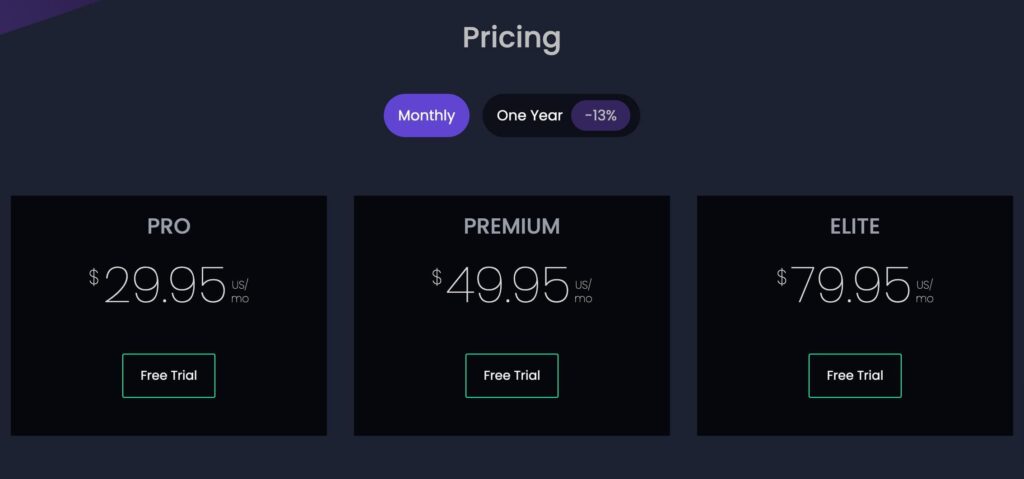

TraderSync Pricing

When it comes to pricing, TraderSync offers both a free version and premium packages. Let’s take a closer look at the features and pricing of each.

Free Version

TraderSync’s free version is a great option for those who are just starting out or don’t need all the bells and whistles. Here’s what you can expect with the free version:

- Trading Journal: You can input your trading data and outcomes into a central system and compare the results.

- Performance Analytics: You can track your performance and analyze your trading behavior.

- Broker Integrations: You can connect with your broker and automatically import your trading data.

Premium Packages

If you’re looking for more advanced features, TraderSync also offers two premium packages: Elite and Premium.

Pro

The Pro package is priced $29.95 per month. Here is what you get:

- Mobile app

- Trade journal

- Trades manual entry

- Trade charting

- Trade import

- Pricing report and much more.

Premium

The Premium package is priced at $49.95 per month or $521 per year. Here’s what you get with the Premium package:

- All the features of the free version

- Evaluator: You can quantify your trading behavior and model potential profit and loss.

It’s important to note that TraderSync offers a free trial for both the Elite and Premium packages, so you can test out the features before committing to a subscription.

Overall, TraderSync’s pricing is competitive and offers a range of options to fit different needs and budgets.

Elite

The Elite package is priced at $79.95 per month. Here’s what you get with the Elite package:

- Allthe features offered by TraderSync

- Evaluator: You can quantify your trading behavior and model potential profit and loss.

- Simulator: You can test different trading strategies and scenarios.

- Advanced Analytics: You can dive deeper into your trading data and get more insights.

Pros and Cons of TraderSync

Advantages

TraderSync offers a variety of tools that can help traders keep track of their trades, analyze their performance, and improve their strategies. Here are some of the advantages of using TraderSync:

- Trading Journal: TraderSync’s trading journal allows you to log and analyze your trades, including entry and exit points, position size, and more. You can also add notes and tags to your trades to help you remember important details.

- Performance Analysis: TraderSync provides detailed performance reports that allow you to analyze your trades and identify areas for improvement. You can view your performance by day, week, month, or year, and compare it to benchmarks like the S&P 500.

- Simulator: TraderSync’s simulator allows you to test your trading strategies in a risk-free environment. You can backtest your strategies using historical data, or practice trading in real-time with a simulated account.

- Multi-Tier Pricing: TraderSync offers a multi-tier pricing structure, with plans ranging from Basic to Elite. This allows traders to choose a plan that fits their budget and their trading needs.

Disadvantages

While TraderSync offers many useful tools, there are also some potential drawbacks to using the platform. Here are some of the disadvantages of using TraderSync:

- Cost: While TraderSync’s pricing is competitive, some traders may find the cost of the platform to be prohibitive, especially if they are just starting out.

- Learning Curve: TraderSync offers many features and tools, which can make the platform somewhat overwhelming for new users. It may take some time to learn how to use all of the features effectively.

- Limited Broker Integrations: TraderSync currently only integrates with a limited number of brokers, which may be a disadvantage for traders who use a different broker.

Overall, TraderSync is a powerful trading journal and analysis tool that can help traders improve their performance and refine their strategies. However, it may not be the best fit for everyone, and traders should carefully consider the pros and cons before deciding whether to use the platform.

Comparisons with Other Trading Tools

When it comes to trading tools, there are many options available in the market. In this section, we will compare TraderSync with some of the popular trading tools to help you make an informed decision.

TraderSync vs Tradervue

Tradervue is another popular trading journal tool that offers similar features to TraderSync. However, TraderSync offers more customization options and a better user interface. TraderSync also offers a wider range of tools and features, including trade analysis, risk management, and performance tracking.

TraderSync vs Edgewonk

Edgewonk is a trading journal tool that focuses on performance analysis and improvement. While it offers advanced analytics and performance tracking, it lacks the customization options and trade analysis features of TraderSync. TraderSync allows you to customize your journal to fit your trading style and provides features like risk management and trade analysis to help you improve your performance.

Overall, while there are many trading tools available in the market, TraderSync stands out for its ease of use, customization options, and range of features. Whether you are a beginner or an experienced trader, TraderSync can help you improve your trading performance and achieve your goals.

Final Thoughts

If you’re looking for a comprehensive trading journal that offers a variety of tools to help you analyze your past trades, TraderSync is definitely worth considering. With its user-friendly interface and automated syncing with Interactive Brokers, it’s a great option for traders of all levels.

One of the standout features of TraderSync is its ability to identify mistakes and provide detailed analytics on your trades. This can be incredibly helpful in improving your trading strategy and avoiding costly errors in the future.

Another great feature is the ability to create custom reports and dashboards, which can help you track your progress and make informed decisions about your trades. Whether you’re a day trader, swing trader, or options trader, TraderSync has the tools you need to succeed.

Overall, TraderSync is a solid choice for anyone looking to take their trading to the next level. With its powerful analytics and user-friendly interface, it’s a must-have tool for serious traders.

Related Articles